Meet Dataiku:

The Universal AI Platform

Meet Dataiku

The Universal AI Platform

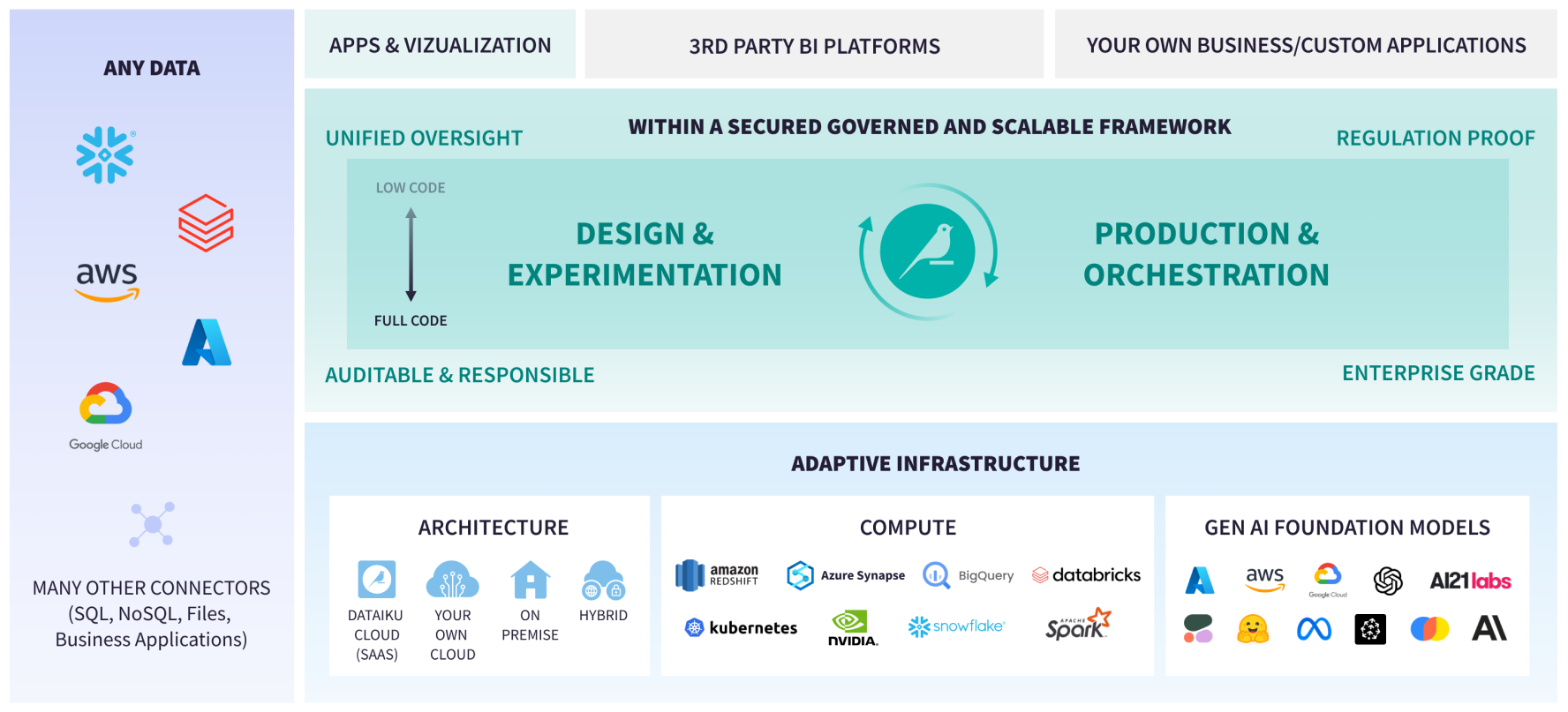

Dataiku covers the full lifecycle of analytics and AI (including Generative AI) projects. From data preparation and model development to solution deployment and ongoing monitoring, Dataiku unites technology, people, and processes with one platform.

Learn More About DataikuSupport everyone (from data to domain experts) in working with data, meeting them where they are with no, low, and full-code features.

Connect to existing infrastructure and integrate with all the latest and greatest technology of today and tomorrow so you can experiment and switch underlying architectures with ease.

Underpin all processes with the governance and right level of oversight required to leverage AI at scale and make informed decisions about risks and resources.

End-to-End Platform

Make the Leap From Descriptive to Predictive

AutoML supports you in building your first or hundredth model, offering the latest machine learning (ML) technologies and tasks in a guided visual framework. Streamline model design and evaluation activities with easy-to-use templates for prediction, clustering, forecasting, causal ML, computer vision, and more.

Visual, large language model (LLM)-powered components mean that everyone can take advantage of the latest Generative AI technologies. Built-in AI Assistants facilitate processes from start to finish, and you can perform prompt engineering, text analysis and enrichment, and even create custom Q&A chatbots … all with no code!

End-to-End Platform

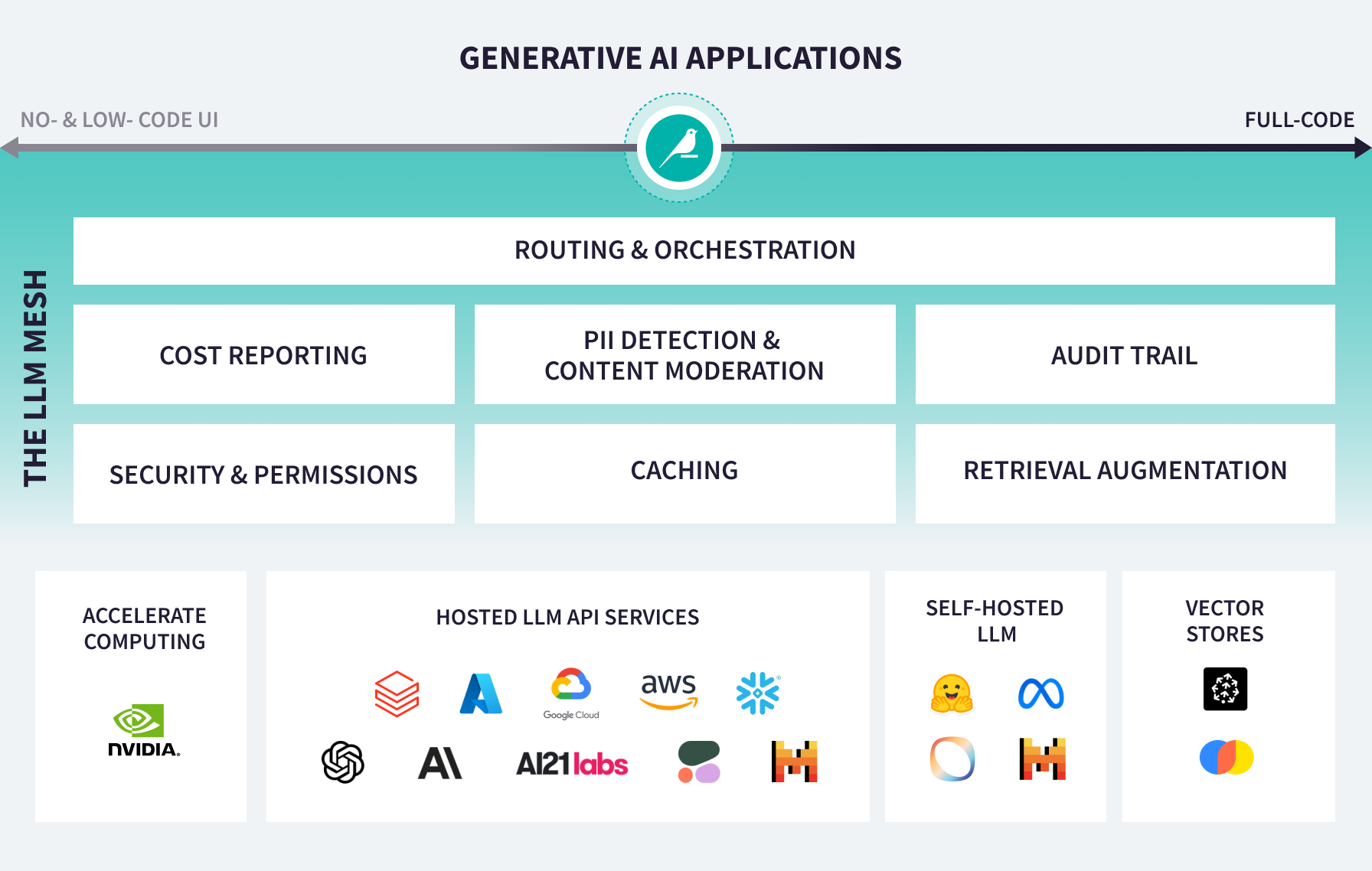

Safely Build Generative AI Applications at Scale

The Dataiku LLM Mesh sits between LLM service providers and end-user applications, reducing risk and giving you the agility to choose the most cost-effective and performant models for your needs.

With LLM Guard Services in Dataiku, maintain clear oversight over LLM costs and apply a variety of usage controls, including identifying and handling personally identifiable information (PII), detecting toxicity, and preventing forbidden terms in both model queries and responses.

To ensure chatbots provide the most relevant, accurate, and trustworthy information possible, apply Retrieval Augmented Generation (RAG) and semantic search techniques in Dataiku to augment foundational LLMs with your own knowledge base.

End-to-End Platform

Smooth Operations for Models & Pipelines

Create your report, pipeline, or model once, and then let Dataiku take over the repetitive work of refreshing it on new data. Automated scenarios monitor for quality issues and alert teams about status or warnings via email or messaging apps like Microsoft Teams and Slack.

With the Deployer in Dataiku, manage project/model versions and infrastructure dependencies for batch and API service deployments. A unified monitoring dashboard provides status and health metrics across dev, test, and prod environments, including models deployed on third-party cloud ML platforms.

Production models periodically need to be updated based on newer data or shifting conditions. Analyze drift and evaluate model performance over time to keep models running at peak performance.

End-to-End Platform

Accelerate Data Preparation by 20-30x

Dataiku’s 40+ data connectors to cloud storage, business applications, flat files, on-premises databases, and everything in between means seamless access for everyone — whether technical or not — to the data they need, all from a single interface.

Empower teams to efficiently wrangle, cleanse, and prepare data, with or without code. Boost productivity thanks to 100+ visual data transformers, a familiar tabular view regardless of data format, AI-enhanced data prep, easy automation, and much more.

End-to-End Platform

Distribute Interactive Insights

Visualize results with 30+ chart types, interactive dashboards, and integration with external visualization tools like Tableau, Power BI, and Qlik. Publish dashboards, apps, and other data assets to central workspaces, where diverse populations of knowledge workers can consume insights.

Build apps with a business user-friendly, visual interface on top of your analysis that others can use to obtain on-demand insights. For more advanced apps, developers can leverage a variety of frameworks (Streamlit, Dash, Gradio, Voilà, etc.) to build custom web apps hosted in Dataiku.

Enterprise-Wide Usability

Go Further Together

Dataiku is a platform where everyone can create or consume AI, regardless of role or technical skill set. With both visual and coder tooling for every task, code or not; the choice is yours!

Teams can discover and reuse others’ work from shared repositories like data collections, feature stores, and code libraries and samples.

For knowledge management and compliance purposes, preserve critical project information with wikis, Flow explanations, and automatic model documentation.

Enterprise-Wide Usability

Deliver Value in Days, Not Months

Dozens of off-the-shelf starter projects accelerate time to value for common industry and horizontal use cases. Dataiku Solutions include ready-to-use objects and workflows that are fully customizable, extensible, and adaptable to your business specifics.

Explore Dataiku SolutionsJoin the more than 90,000 learners taking online Dataiku Academy courses and certifications to improve their mastery of the product, or connect with other data professionals in the Dataiku Community for peer-to-peer support. For more technical depth, the knowledge base, developer guide, and reference documentation contain a wealth of information.

Explore the Dataiku AcademyFlexible, Modular Architecture

Orchestrate With High Performance & Scalability

Dataiku sits on top of your infrastructure of choice, so you can leverage data storage and compute investments with providers like Snowflake, Databricks, AWS, Azure, and GCP. A fully-managed, SaaS cloud offering allows teams to get up and running in days, not months, so you can focus on analysis, not server administration.

For maximum performance and efficiency on large workloads, Dataiku uses a pushdown architecture that allows organizations to take advantage of GPUs and elastic, and highly scalable computing systems including SQL databases, Spark, Kubernetes, and more.

Governance Framework

Maintain Oversight, From Design to Delivery

With Dataiku Govern, teams can prioritize data projects and gain visibility into the status of all AI and analytics initiatives, all from a central watchtower.

Use project and workflow templates to define clear phases for data projects, from start to finish. Assign stakeholders, capture notes, and attach relevant documentation to each stage of a workflow to ensure the entire process is documented and tracked.

To ensure both audit-readiness and stakeholder alignment, request reviews and sign-off on models or project bundles prior to promoting them to production. Without appropriate approval, deployments will be blocked.

Central registries allow operators and leadership to see all governed models and pipelines in a single place, versioned, with performance metrics and project summaries.

Customer Testimonials

Get Your Return on AI

Tens of thousands of people across more than 600 companies worldwide get measurable ROAI using Dataiku for diverse use cases.

Get Your Return on AI With Dataiku

Next Steps

© 2013 – 2024 Dataiku. All rights reserved Privacy Policy